Social Security can be a valuable asset to those who are retiring. It also is the part of retirement planning that generates questions and can be confusing to many. For many, it is no longer just a matter of “when do I take my benefit”. Your retirement date and the date you begin your Social Security benefits do not have to be the same. However, making certain decisions concerning Social Security can be costly in retirement.

Social Security provides a foundation on which to build retirement security. However, Social Security benefits were never intended to be someone’s sole source of income in retirement, these benefits should be supplemented.

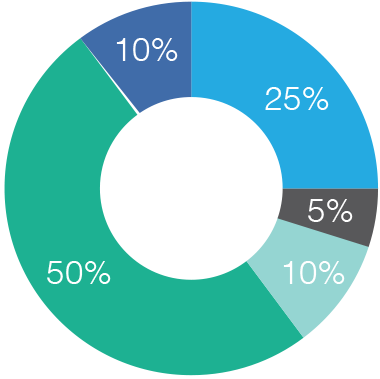

They can however, account for a large portion people’s income in retirement and needs to be planned for like such. This income stream can play a more significant role in the later years of retirement than the early years as other income sources start to drawdown. Planning on how and when to address Social Security is an important part of our client’s retirement strategy.

How are my benefits taxed? What about spousal benefits? Won’t my Spouse get have my benefit? If I die, what benefit does my spouse get? Can I File on my ex’s benefit? Should I take my benefit early? At Romero Retirement Strategies, we are here to help answer your Social Security questions.

This website and the licensed insurance agent are not affiliated nor endorsed by the Social Security Administration (“SSA”) or any other government agency. Only the SSA can determine and pay social security benefits.